This is not a Pick 5 bet in horse racing but a selection of five business events news which caught our team’s attention. This issue with a focus on AUSTRALASIA is compiled by Faye Langley and Mike Williams who are based in Sydney and Melbourne respectively. The global pandemic has resulted in many landscape changes… Continue reading GainingEdge’s Pick 5: Five News Items You Need to Know

Author: 3lane

Video Interview: Rod Kamleshwaran on the China National Convention Center, Phase 2 (CNCC-II)

Located in the Beijing Olympic Green Area, the China National Convention Center, Phase 2 (CNCC-II) – one of the key projects in Beijing’s strategic development plan – is on track to open in 2025. Designed by French architect Christian de Portzamparc, the venue previously served as the main media centre for the Beijing 2022 Winter… Continue reading Video Interview: Rod Kamleshwaran on the China National Convention Center, Phase 2 (CNCC-II)

CBCC-II Makes International Debut as Beijing’s Newest International Convention Center at IMEX 2022 Frankfurt (Stand A210)

PRESS RELEASE China National Convention Center, Phase 2 (CNCC-II) is located in the Beijing Olympic Green Area, in the north of Beijing. Having successfully served as the Main Media Center (MMC) for the recently concluded Beijing 2022 Winter Olympics. CNCC-II is on track to begin its next phase as China’s premier international convention center. At… Continue reading CBCC-II Makes International Debut as Beijing’s Newest International Convention Center at IMEX 2022 Frankfurt (Stand A210)

2nd Annual: GainingEdge Ranks Intellectual Capital of Conference Destinations

PRESS RELEASE Global convention industry consulting firm, GainingEdge, has launched its second annual report on Leveraging Intellectual Capital of convention destinations, based on its analysis of international association leadership. The research underpinning this report identifies the relative strengths of 350 destinations via the presence of their local intellectual leaders in the governing bodies of international… Continue reading 2nd Annual: GainingEdge Ranks Intellectual Capital of Conference Destinations

GainingEdge’s Pick 5: Five News Items You Need to Know

This is not a Pick 5 bet in horse racing but a selection of five business events news which caught our team’s attention. Paul, Jon and Steve are all based in Vancouver.

This Pick 5 issue focuses on recent news making the rounds with two prominent organizations in North America. Destinations International is based in the U.S. and is a leader in this continent in providing education, advocacy, and business opportunities. Destination Canada Business Events focuses on the strategic value of Canada as a business events destination, while always keeping an eye on global trends. We are also pleased to be working with them on the world’s largest legacy impact project.

The following articles caught our attention as they have relevance both from a domestic and international perspective. Given the global nature of our industry, it is necessary to know what is going on at home as well as abroad. The articles below reflect perspectives from such experts as the AIPC, ICCA, UFI, PCMA, HeadQuarters Magazine, and Digital Edge. Additionally, we recognize the importance of leisure travel and tourism for DMOs and CVBs in the North American market and have included an article below from Expedia on the outlook for 2022.

Happy reading!

Compiled by:

Business Events are the Fast Track to Recovery

The G3 says that Business Events are needed now more than ever for one essential reason – to put economies and societies on a fast track towards recovery post Covid-19.

The International Association of Convention Centres (AIPC), the International Congress and Convention Association (ICCA) and the Global Association of the Exhibition Industry (UFI) launched a new policy White Paper supporting Business Events recovery called: Business Events are the Fast Track to Recovery. Kai Hattendorf, UFI CEO, sums it up succinctly: “Industries need B2B meetings as much as governments need G2G meetings. These aren’t mass events. They’re all about businesspeople gathering to get business done.”

[SOURCE: DESTINATION CANADA BUSINESS EVENTS]

PCMA Convene COVID-19 Survey reveal more deliberate plans for in-person and hybrid events

The February Recovery Dashboard reveals more optimism.

PCMA reported 56 percent of planners described themselves as hopeful in February (link to: February Dashboard compared to 49 percent in the December Dashboard; and 58 percent of suppliers expressed optimism in this survey, up 15 percentage points from December. Nearly half will be holding an in-person-only event in 2022; 35 percent digital only; and 41 percent hybrid, down from 46 percent who selected hybrid in December.

36 percent of planners expect an up-to-50-percent decline in registration numbers at their 2022 events compared to their pre-COVID events and more than one-third said they are unable to estimate registration numbers. One planner said the challenge in this fluid environment is ensuring hard-cost expenses like F&B minimums and AV “without really knowing what attendance turnout will be.”

[SOURCE: PCMA]

Social Legacies and Impacts for the Meetings Industry

The time is ripe for a new advocacy of social legacies and impacts for the meetings industry, says HQ Magazine.

In the latest edition of Headquarters, Meeting Media Group explores the legacies of events and the long-term intellectual, social, and economic impact they can have on a destination. “We see a major reversal in the importance that congresses can have for society. Whereas conferences used to be an important source of prestige and income, we are now seeing a shift towards more intrinsic values,” said Marcel A.M. Vissers, Editor-in-Chief. Read more

[SOURCE: HQ MAGAZINE]

Key Trends Affecting the Meetings Industry

The writing is on the wall – Change, Sustainability and Collaboration.

This content was presented at the Destinations International Convention Sales and Services Summit which focused on the trends and changes affecting the meetings industry and destination sales. The key trends are:

• The Only Constant is Change

• Sustainability is Getting Stronger

• Collaboration Fosters Innovation

[SOURCE: DESTINATIONS INTERNATIONAL]

Trends and Best Practices to Inform Your Destination Marketing Strategy

After living in the pandemic for two years, relaxation and decompression will be top of mind.

With borders reopening and people eager to travel again, Expedia Marketing Group conducted a survey of 5500 people and provided the following summary of their findings on the outlook for tourism in 2022. The results reveal potential for ongoing recovery driven by strong interest in leisure travel. A few interesting best practices are included. Read more

[SOURCE: DESTINATIONS INTERNATIONAL]

Where to Meet GainingEdge (May – July 2022):

IT&CM China (virtual)

IMEX Frankfurt

Gary Grimmer, Jane Vong Holmes, Bruce Redor, Milos Milovanovic, Alessandra Delmonte, Stevie Carey, Chloe Menhinick

For Guadalajara CVB: Helen Crompton, Molly Doheny

For BestCities Global Alliance: Lesley Williams, Tia Daniels

For China National Convention Centre phase 2 (CNCC-II): Rod Kamleshwaran

This is not a Pick 5 bet in horse racing but a selection of five business events news which caught our team’s attention. Paul, Jon and Steve are all based in Vancouver.

GainingEdge Advisory Issue

What Meeting Planners Are Looking For Meeting and event planners, like much of the business events industry, are facing many challenges during the ongoing pandemic that does not seem to have an immediate end. Challenges According to the PCMA APAC COVID_19 Survey 2021 the two key areas of concern relate to safety and local support.… Continue reading GainingEdge Advisory Issue

GainingEdge’s Pick 5: Five News Items You Need to Know

This is not a Pick 5 bet in horse racing but a selection of five business events news which caught our team’s attention. This issue with a focus on ASIA is compiled by Jane Vong Holmes and Nigel Brown who are based in Kuala Lumpur and Singapore respectively. “Our just released International Convention Competitive Index… Continue reading GainingEdge’s Pick 5: Five News Items You Need to Know

2021 Destination Competitive Index Offers Advanced Tools for Business Recovery

PRESS RELEASE Global convention industry consulting firm, GainingEdge, has released its fourth annual Competitive Index of international convention destinations. The 2021 edition ranks the world’s top cities in terms of key draw factors for meeting planners. GainingEdge Analysis & Research (GEAR) Head, Milos Milovanovic, said the main purpose of the Destination Competitive Index is to… Continue reading 2021 Destination Competitive Index Offers Advanced Tools for Business Recovery

Beijing North Star Convention and Exhibition Investment Co., Ltd and GainingEdge Enter into Strategic Partnership on Project China National Convention Center II (CNCC-II)

PRESS RELEASE Beijing North Star Convention and Exhibition Investment Co., Ltd., the investor and developer of the complex project “China National Convention Centre (Phase Two)” (CNCC-II), has reached strategic cooperation with GainingEdge, a world-renowned international consulting company for convention centers and business events. GainingEdge will be responsible for the pre-opening operation and marketing of the… Continue reading Beijing North Star Convention and Exhibition Investment Co., Ltd and GainingEdge Enter into Strategic Partnership on Project China National Convention Center II (CNCC-II)

GainingEdge Advisory Issue

Building a Better Business Case

The ongoing impacts of COVID have really shown everyone, including governments, the importance of business events, and their direct and more long-term, indirect benefits to our communities, our cities and our countries. COVID has also left many of us competing for funding with other competing priorities, be they health spend, income assistance programs, infrastructure programs, amongst others. So, for us to compete in these tough times, we need to be better able to articulate the total benefits of business events to our stakeholders…including our funders.

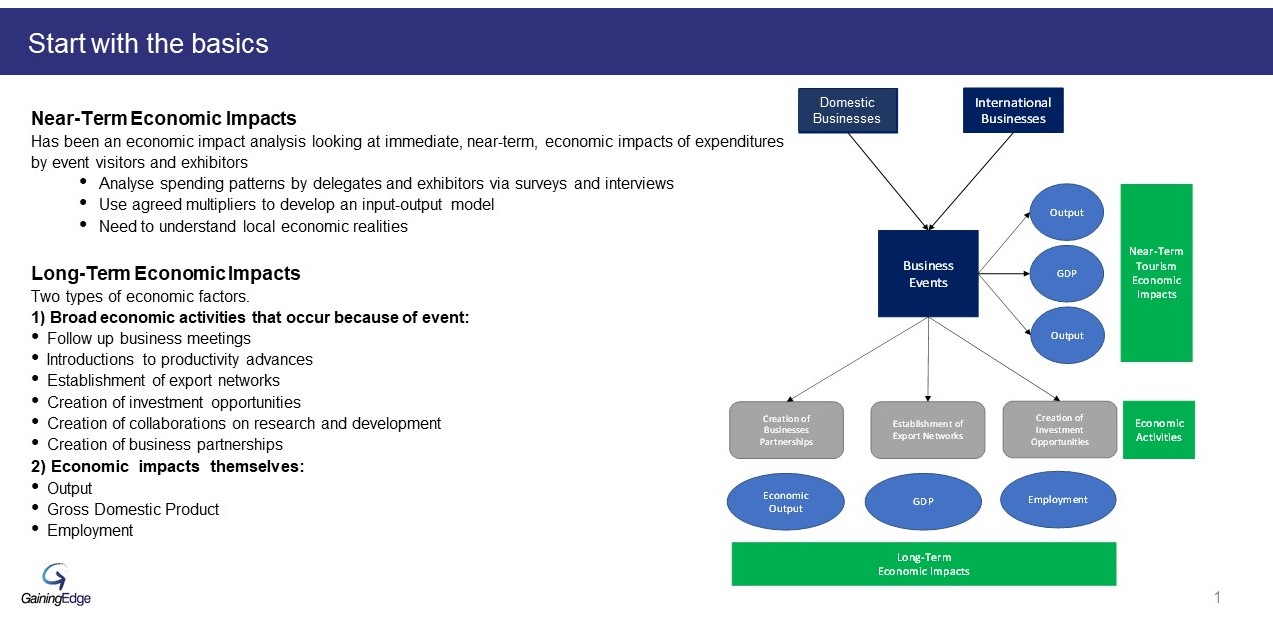

Traditionally, the business case has been, at best, a calculation of the near-term economic impact benefits of an event. Usually calculated by determining the spend of visitors and organisers via survey and interviews. In many, but not all, countries there are then economic multipliers that can be used to estimate the near-term financial and employment benefit of a business event, usually via an input-output model. And these impacts can be estimated at the direct level (so changes that occur in the “front-end” businesses), indirect level (so changes in activity for suppliers of the “front-end” businesses) and the induced level (so spending on goods and services resulting from increases to the payroll of the directly and indirectly affected businesses). Sounds simple right? There are even various websites and calculators that will give you a supposed near-term impact calculation.

However, we find even this relatively simple part of the calculation is often done wrong. Many economic impact calculators, and even many firms that do this, make simple mistakes that your stakeholders could see and then call into question your analysis. Starting with the data capture: 1) it’s a common error to double count the spend of the organising Association with the registration fees paid by attendees; 2) another is the total event attendee and the accompanying person spend is not captured properly, or only includes the spend during the event and not the spend pre and post event, which reduces the actual calculated event impact (not good!); 3) Airfares are often miscounted, with international airfares included when it should only be domestic flights – just a few examples.

Assuming we have the data captured correctly, there are still many other areas we see done incorrectly, especially in those destinations without agreed economic multipliers. This impact analysis is not a one-size fits all. It needs to take account of local economic realities and if we don’t have robust multipliers then we need to look for similar markets as comparison and adjust those based on our local market understanding. Without all of this, our analysis is, at best, inaccurate and, at worst, wrong. And our ever more sophisticated stakeholders and funders will see right through this.

So that was the easy part, right? And that may have been all that was needed before. But more and more we’re seeing destinations need a more robust, and convincing, business case that will also look at the long-term economic impacts, and the legacy impacts, of an event. These types of impacts may only be realised years in the future.

The identification and quantification of long-term economic impacts is much more complicated and involves two types of economic factors:

- The first type of factor consists of broad economic activities that occur because of the event. These activities may be wide in scope and may be tangible or intangible in nature, such as follow up meetings, new investment opportunities, new export routes opened, or new business partnerships. These activities are not economic impacts but are intermediaries that lead to the creation of long-term economic impacts. So, we need to identify and measure them to allow us to quantify the long-term economic impacts.

- The second type of factor is the long-term economic impacts themselves. The most common measures used in quantifying long-term economic impacts are: 1) output (the total gross value of goods and services produced); 2) GDP, or value added, the additional value of a good or service over the cost of producing it; and 3) employment, the number of additional jobs created.

These are the factors that are going to get the attention of other parts of government, those looking at economic development, job creation, generally those areas of government with ultimate control of the purse strings and with bigger budgets…but as I’ve alluded to, estimating the long-term economic impact requires us to understand exactly WHICH economic activities will create the economic impact and be able to measure them. And this has seldom been done for events.

And this brings us to what a Better Business Case can be, which is much more than only the Near-Term economic impacts. A Better Business Case will also look at, the long-term economic impacts…which are in fact part of what makes up the Legacy Impact(s) of an event. And a Better Business Case will also be further justifying the event via also looking at what are the desired meeting outcomes (which are Legacy Drivers), from which we are now able (through GE’s work on Legacy Impacts) to build a narrative around the additional long-term Legacy benefits, or impacts, of an event. Some of these are provided on this slide, and they can range from improved exports, to improved health outcomes, to improved social outcomes, to increased investment or talent attraction…. amongst many others. These are outcomes and legacy impacts that are far beyond the traditional for tourism and business events. And these Legacies can be powerful motivators across a myriad of stakeholders and, importantly, open up new funding sources.

Unlike the economic impact assessment where we have generally accepted models and principles, the approach to Legacy is much more varied because there are more variables around event types and sectors. But there is now an accepted framework for how to categorise and measure. Each type of event can have environmental, political, obviously economic, sectoral and social legacies. And these legacies can occur at four levels: 1) The more personal, around knowledge sharing; 2) the Professional Community; 3) at the Sectoral Level; and 4) what we call world changing legacies, such as of the type described by the UN SDGs. The type of legacies, and the levels they attain, are bespoke to each event and so can be their measurement. But if the work is done upfront in the business case, these can be identified, measured, and via this process their impact can even be increased.

Additionally, if the business case also provides for a system and means of measurement of economic and legacy impacts – we will then have additional retrospective data and justification for the event. And so therefore the next event proposed will then have an even stronger, better business case. So, this Better Business Case will not only serve as a rational justification of the event before it occurs, it will put in place a system and process to justify the event after the event has happened….and further the business cases of future events. And that, is a Better Business Case!

ABOUT THE AUTHOR JON SIVERTSON

Jon Sivertson is GainingEdge’s CEO and oversees GainingEdge’s consultancies.

Jon has his roots deep in infrastructure development and financing, and project feasibility of convention and exhibition centres.

Prior to joining GainingEdge and bringing over 20 years of experience to our team, Jon has worked with PwC in Canada, New Zealand and Singapore and was instrumental in PwC’s infrastructure group achieving its status as a Centre of Excellence for the PwC network in Southeast Asia, Hong Kong and China.

He is a specialist in Public Private Partnership (PPP) projects.

Email Jon

For more articles/news, please visit News & Resources.

Advice: COVID-19 for destinations and convention bureaus Issue #8.