7 August 2020

On 30 July, UNWTO reported that 40% of destinations have eased travel restrictions. On the same day, WHO issued guidelines for resuming travel saying travel bans due to Covid-19 cannot be indefinite.

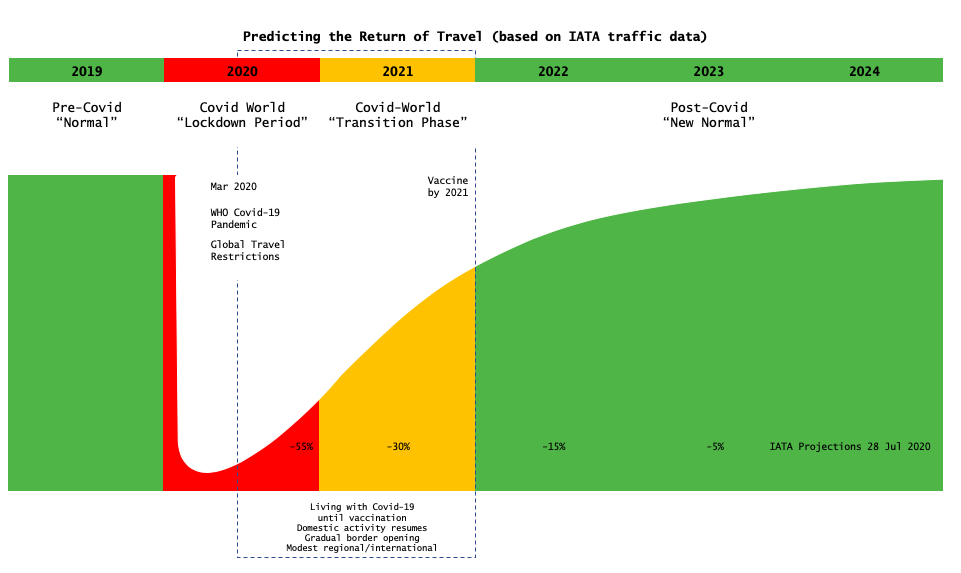

We are now in a Transition Phase where economic activity is resuming in a world inclusive of Covid-19. This phase will last until widespread vaccination, probably not before 2022, when the New Normal without the virus begins.

IATA, July 2020 reports that passenger numbers in 2020 will drop by 55%, to 2006 levels, and may not recover to 2019 levels until 2024.

STR, June 2020 predicts that USA hotel revenue per available room (RevPAR) is unlikely to return to 2019 levels before 2023.

Air traffic and hotel demand are broad indicators for the meetings, incentives, conventions, and exhibitions (MICE) sector. Recovery of the MICE sector seems unlikely to take less than 5 years.

The pace and level of recovery will vary by region and business segment. Domestic markets will return before international, and leisure segments will precede business segments. As the crisis is unprecedented and still evolving, the full recovery period remains uncertain.

The “Lockdown Period”

The relates primarily to March through May after the Covid-19 pandemic was announced spurring a global lockdown. This led to the closure of borders and most economic activity. In many countries, non-essential activities ceased for up to 4 months. Many imposed curfews.

Past crises were confined to smaller segments of the world. Not this time. On 6 April 2020, WHO reported that 96% of all worldwide destinations had introduced travel restrictions. IATA reported a 94% drop in air traffic for April 2020.

Many emerging and developing economies remain in lockdown as Covid-19 intensifies.

The “Transition Phase”

Most countries are now in this second phase. The reopening is not just of countries that have suppressed Covid-19 but also those with high active cases and so with the risks of second waves of infections and re-imposition of lockdowns.

June marked widescale relaxations in restrictions allowing domestic market activity in many countries. In the same month, some destinations began opening up to regional markets.

In July, UNWTO reported that 40% of destinations easing travel restrictions, up from 22% in June. Of the 87 countries to ease travel restrictions, four completely lifted all travel restrictions – Albania, Maldives, Serbia and Tanzania.

115 destinations including Australia, Canada and India continue to keep their borders completely closed.

The gradual opening is largely attributed to the Northern Hemisphere summer season led by the opening of borders in the European Union on 1 July. Europe leads the opening with 41 nations, 20 in the Americas, 13 in Africa, 10 in Asia-Pacific, and 3 in the Middle East.

China and USA – countries with strong domestic bases are leading the recovery pack with weekly occupancies of up to 55% and 48% respectively in late July. STR is reporting other regions at barely much more than 20%. USA hotels tend to rely more on MICE business than in the Asia Pacific where the leisure market is more dominant. Without this group business, the USA hotel recovery will plateau.

If the 87 countries manage this large-scale travel without a significant rise in cases, it will go a long way towards creating the consumer confidence needed for a genuine recovery. Conversely, a spike in cases risks a major setback.

Hotel recovery is led by non-luxury categories with domestic leisure peaking on weekends. Corporate travel recovery has begun in some markets, but many small meetings will not return from the virtual platforms adopted during the lockdown.

MICE sector recovery is led by domestic events. Protocols include contactless registration, thermal scanning, face masks, elevated hygiene and social distancing. Social distancing is easier to handle with exhibitions than conferences. Countries like China, Korea, Taiwan and Germany are leading the return of large-scale events with exhibitions and government events.

Many events have turned to virtual or hybrid formats in the short term. The importance of digitisation and flexibility of venues has escalated. Multi-location events where in-person events in different regional locations connect online to form a larger global event are growing. This is appealing in the current phase as attendees lack confidence for travel and large gatherings.

The “New Normal”

This has been described as a once-in-a-century pandemic. It has challenged us to completely re-evaluate how we think, live and work.

The 9/11 terror attacks led to dramatic changes in attitudes to safety, security and privacy. Covid-19 is having a dramatic impact on geopolitics, technology and social attitudes. Technology has proven fundamental to coping with this disruption. Driven to better prepare for the next pandemic or biosecurity threat, organisations will seek to strengthen agility and resilience.

It has long been accepted that there is a strong relationship between the unemployment rate and hotel demand. Hence, at some point, consumer behaviour will be dependent on economic, not health factors. After borders are wide open and consumer confidence in safe travel has returned, economics will influence hotel demand.

There will be significant shifts in the MICE industry in the post Covid-19 era. Some will be structural and permanent. Some will be temporary. Some are already in place.

Once the viral threat has faded, the attention on hygiene and social distancing may also fade.

In-person interaction remains powerful and unlikely to be replaced by virtual events in a dominant way. In-person events are attractive for commercial and networking purposes. Most events will return as in-person events, but a high portion will be hybrid events.

Covid-19 will accelerate digital trends. Consumer exhibitions will embrace virtual event formats more readily than trade exhibitions. Corporates will in future distinguish between essential and non-essential travel. Some meetings, especially internal meetings, will not fully return to pre Covid-19 levels.

Venue offers will include in-person, hybrid or virtual options with enhanced technology infrastructure and flexible rooms. Virtual tours for venues will be the norm. Virtual meeting and event software will improve at a rapid pace. Contactless operations beyond check-in is here to stay.

New certifications, accreditations and quality standards on hygiene will be normal.

Solutions for crowd monitoring, electrostatic sprayers to disinfect surfaces in function rooms and public spaces, automated self-cleaning machines for escalators, and enhanced air filtration systems for ventilation will be promoted as safety features at many venues.

Venues will need to assess both “hardware” and “software” readiness for this New Normal.

When this New Normal without Covid-19 begins is unclear. Even after a vaccine is found, it may take a year or more before widespread vaccination and the confidence for mass travel returns. A consensus is emerging that the virus will stay for a while and the world has to figure out how to live with it.

We shouldn’t let our high hopes for a vaccine deter us from finding solutions that let us live as close to normal as possible now, even in a highly disrupted world with Covid-19. But we must also be cognisant of the risks of second waves of infections and re-imposition of lockdowns.