What Meeting Planners Are Looking For Meeting and event planners, like much of the business events industry, are facing many challenges during the ongoing pandemic that does not seem to have an immediate end. Challenges According to the PCMA APAC COVID_19 Survey 2021 the two key areas of concern relate to safety and local support.… Continue reading GainingEdge Advisory Issue

Region: Central and South America

Destination Competitive Index 2021

Our focus in 2021 was to analyse destinations’ competitiveness with the aim to help them understand which strategies and activities they can use to speed up their recovery post-pandemic.

2021 Destination Competitive Index Offers Advanced Tools for Business Recovery

PRESS RELEASE Global convention industry consulting firm, GainingEdge, has released its fourth annual Competitive Index of international convention destinations. The 2021 edition ranks the world’s top cities in terms of key draw factors for meeting planners. GainingEdge Analysis & Research (GEAR) Head, Milos Milovanovic, said the main purpose of the Destination Competitive Index is to… Continue reading 2021 Destination Competitive Index Offers Advanced Tools for Business Recovery

GainingEdge Advisory Issue

Building a Better Business Case

The ongoing impacts of COVID have really shown everyone, including governments, the importance of business events, and their direct and more long-term, indirect benefits to our communities, our cities and our countries. COVID has also left many of us competing for funding with other competing priorities, be they health spend, income assistance programs, infrastructure programs, amongst others. So, for us to compete in these tough times, we need to be better able to articulate the total benefits of business events to our stakeholders…including our funders.

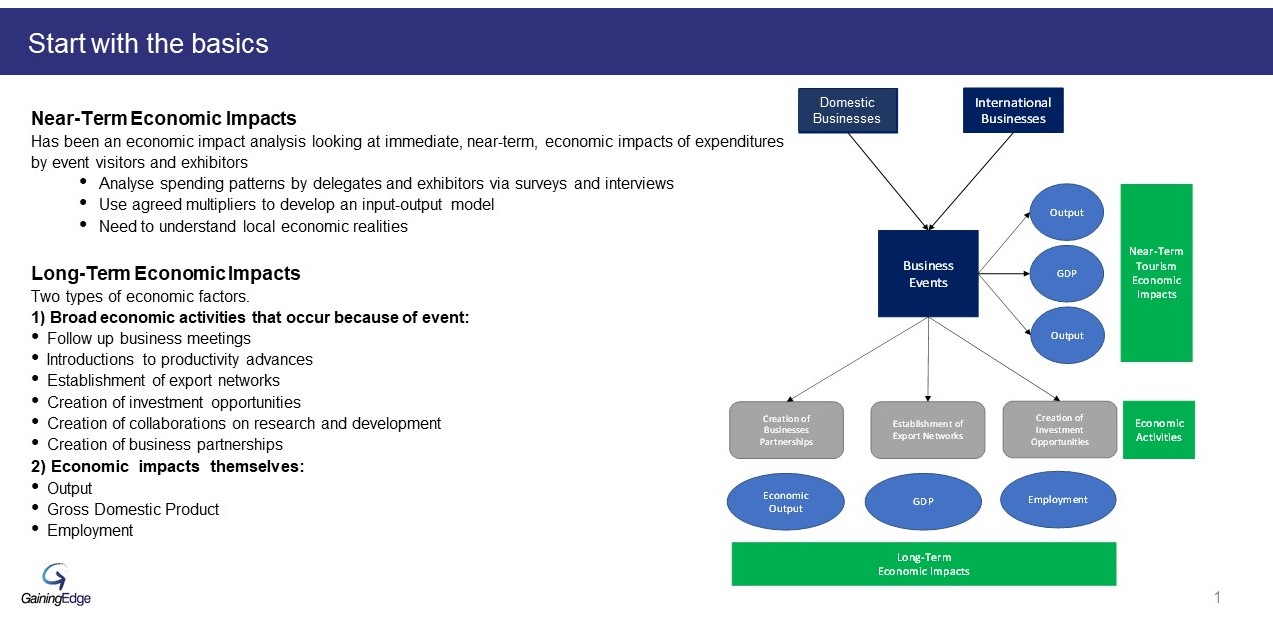

Traditionally, the business case has been, at best, a calculation of the near-term economic impact benefits of an event. Usually calculated by determining the spend of visitors and organisers via survey and interviews. In many, but not all, countries there are then economic multipliers that can be used to estimate the near-term financial and employment benefit of a business event, usually via an input-output model. And these impacts can be estimated at the direct level (so changes that occur in the “front-end” businesses), indirect level (so changes in activity for suppliers of the “front-end” businesses) and the induced level (so spending on goods and services resulting from increases to the payroll of the directly and indirectly affected businesses). Sounds simple right? There are even various websites and calculators that will give you a supposed near-term impact calculation.

However, we find even this relatively simple part of the calculation is often done wrong. Many economic impact calculators, and even many firms that do this, make simple mistakes that your stakeholders could see and then call into question your analysis. Starting with the data capture: 1) it’s a common error to double count the spend of the organising Association with the registration fees paid by attendees; 2) another is the total event attendee and the accompanying person spend is not captured properly, or only includes the spend during the event and not the spend pre and post event, which reduces the actual calculated event impact (not good!); 3) Airfares are often miscounted, with international airfares included when it should only be domestic flights – just a few examples.

Assuming we have the data captured correctly, there are still many other areas we see done incorrectly, especially in those destinations without agreed economic multipliers. This impact analysis is not a one-size fits all. It needs to take account of local economic realities and if we don’t have robust multipliers then we need to look for similar markets as comparison and adjust those based on our local market understanding. Without all of this, our analysis is, at best, inaccurate and, at worst, wrong. And our ever more sophisticated stakeholders and funders will see right through this.

So that was the easy part, right? And that may have been all that was needed before. But more and more we’re seeing destinations need a more robust, and convincing, business case that will also look at the long-term economic impacts, and the legacy impacts, of an event. These types of impacts may only be realised years in the future.

The identification and quantification of long-term economic impacts is much more complicated and involves two types of economic factors:

- The first type of factor consists of broad economic activities that occur because of the event. These activities may be wide in scope and may be tangible or intangible in nature, such as follow up meetings, new investment opportunities, new export routes opened, or new business partnerships. These activities are not economic impacts but are intermediaries that lead to the creation of long-term economic impacts. So, we need to identify and measure them to allow us to quantify the long-term economic impacts.

- The second type of factor is the long-term economic impacts themselves. The most common measures used in quantifying long-term economic impacts are: 1) output (the total gross value of goods and services produced); 2) GDP, or value added, the additional value of a good or service over the cost of producing it; and 3) employment, the number of additional jobs created.

These are the factors that are going to get the attention of other parts of government, those looking at economic development, job creation, generally those areas of government with ultimate control of the purse strings and with bigger budgets…but as I’ve alluded to, estimating the long-term economic impact requires us to understand exactly WHICH economic activities will create the economic impact and be able to measure them. And this has seldom been done for events.

And this brings us to what a Better Business Case can be, which is much more than only the Near-Term economic impacts. A Better Business Case will also look at, the long-term economic impacts…which are in fact part of what makes up the Legacy Impact(s) of an event. And a Better Business Case will also be further justifying the event via also looking at what are the desired meeting outcomes (which are Legacy Drivers), from which we are now able (through GE’s work on Legacy Impacts) to build a narrative around the additional long-term Legacy benefits, or impacts, of an event. Some of these are provided on this slide, and they can range from improved exports, to improved health outcomes, to improved social outcomes, to increased investment or talent attraction…. amongst many others. These are outcomes and legacy impacts that are far beyond the traditional for tourism and business events. And these Legacies can be powerful motivators across a myriad of stakeholders and, importantly, open up new funding sources.

Unlike the economic impact assessment where we have generally accepted models and principles, the approach to Legacy is much more varied because there are more variables around event types and sectors. But there is now an accepted framework for how to categorise and measure. Each type of event can have environmental, political, obviously economic, sectoral and social legacies. And these legacies can occur at four levels: 1) The more personal, around knowledge sharing; 2) the Professional Community; 3) at the Sectoral Level; and 4) what we call world changing legacies, such as of the type described by the UN SDGs. The type of legacies, and the levels they attain, are bespoke to each event and so can be their measurement. But if the work is done upfront in the business case, these can be identified, measured, and via this process their impact can even be increased.

Additionally, if the business case also provides for a system and means of measurement of economic and legacy impacts – we will then have additional retrospective data and justification for the event. And so therefore the next event proposed will then have an even stronger, better business case. So, this Better Business Case will not only serve as a rational justification of the event before it occurs, it will put in place a system and process to justify the event after the event has happened….and further the business cases of future events. And that, is a Better Business Case!

ABOUT THE AUTHOR JON SIVERTSON

Jon Sivertson is GainingEdge’s CEO and oversees GainingEdge’s consultancies.

Jon has his roots deep in infrastructure development and financing, and project feasibility of convention and exhibition centres.

Prior to joining GainingEdge and bringing over 20 years of experience to our team, Jon has worked with PwC in Canada, New Zealand and Singapore and was instrumental in PwC’s infrastructure group achieving its status as a Centre of Excellence for the PwC network in Southeast Asia, Hong Kong and China.

He is a specialist in Public Private Partnership (PPP) projects.

Email Jon

For more articles/news, please visit News & Resources.

Advice: COVID-19 for destinations and convention bureaus Issue #8.

Bulletin: COVID-19

REGION WATCH

ASIA

Busan extends support to include virtual and hybrid events

Source: Edited excerpt from TTG MICE

Date:1 November 2021

Busan, a large port city in South Korea, has adopted the tagline “Busan MICE Must Go On”. The Busan Tourism Organization (BTO), initially had a support fund that went towards hosting international conferences, but this has since been expanded to include virtual and hybrid meetings. For instance, for events where 10 per cent of the participants attend in-person, the event will still obtain 100 per cent support.

Singapore’s Vaccinated Travel Lane (VTL) scheme

Source: Edited excerpt from Travel and Tour World

Date: 5 November 2021

The expanded Vaccinated Travel Lane (VTL) scheme has given the business events sector in Singapore a boost, with industry players noting growing interest among their clients. Mr Mathias Posch, President of International Conference Services, said that several large-scale conferences are now considering Singapore as a destination, including discussions about relocating conferences from other Asian destinations to the Republic.

Business Events Sarawak Legacy (BESLegacy) Initiative

Source: Edited excerpt from New Sarawak Tribune

Date: 9 November 2021

Business Events Sarawak (BESarawak) has launched Sarawak’s legacy planning guideline called Business Events Sarawak Legacy (BESLegacy) Initiative, where business event planners can strategically design their convention activities to achieve their legacy outcomes. The Sarawak government is in full support of convention legacies as it is one of the key strategies to help achieve the Post Covid Development Strategy (PCDS) 2030 goals.

Sarawak’s Tribespirit Teambuilding app

Source: Business Events Sarawak website

Date: 15 November 2021

Business events in Sarawak are preparing for the return of international business events and incentives with the launch of a new treasure-hunt inspired teambuilding product. Participants can test their team leadership skills through a series of physical challenges throughout Kuching city and trivia quizzes on Sarawak’s culture, adventure, nature, food and festivals. Developed by teambuilding provider Asia Ability, the Go Team app enables organisers to manage and monitor on-ground activities remotely with updates, feedback, and scores kept in real-time to give the programme a more tailored and future-forward experience.

AUSTRALASIA

New Zealand’s Event Transition Support Scheme

Source: Edited excerpt from CIM

Date: 9 November 2021

The New Zealand government has announced new financial support to give event organisers greater certainty to proceed, with the government to shoulder the lion’s share of risk during planning stages. The Events Transition Support Scheme will cover 90 per cent of unrecoverable costs for paid, ticketed events with audiences of more than 5,000 vaccinated people, if organisers are forced to cancel or postpone due to Covid-19 public health measures.

Victoria’s COVID-19 event cancellation insurance scheme

Source: Edited excerpt from Special Events and CIM

Date: 16 November 2021

The Victorian Government has announced an AUD 230 million (USD 164.2 million) Covid-19 event cancellation insurance scheme through the Victorian Managed Insurance Authority. The 12-month scheme will insure events against cancellation due to public health measures, or where events have reduced capacity due to restrictions.

Melbourne’s Knowledge Partnership Program

Source: Edited excerpt from MICENET

Date: 19 November 2021

Melbourne Convention Bureau (MCB) has launched a new Knowledge Partnership Program aimed at attracting international conferences to Melbourne, placing world-leading research on the global stage, developing connections to academics to facilitate strong education programs, powerful knowledge sharing and fostering world-leading innovations. MCB’s launch of the new Knowledge Partnership Program is designed to aid recovery by building Victoria’s profile and competitiveness.

EUROPE

State of meeting subventions report

Source: Edited excerpt from Boadroom Magazine and Meetings HQ

Date: 11 November 2021

Conferli has released a market study on the status of subventions in a post-pandemic world, with a focus on European destinations.

Read it here.

#KrakówTheHostCity social media campaign

Source: Edited excerpt from Kongres Magazine

Date: 9 November 2021

Kraków Convention Bureau has implemented a new social media communication strategy that leverages the city’s strongest assets, leading sectors and resources. The focus is on the city’s strengths and areas that were not severely affected by the COVID-19 pandemic. Eight main areas are presented on social media: Science & Research, Industry, Business & Technology, Culture & Art, The Host City, Heritage & Identity, Smart City and International Relations.

Northern Ireland’s Ambassador Circle

Source: Edited excerpt from Meetings HQ

Date: 24 November 2021

In partnership with Invest Northern Ireland, Visit Belfast and Visit Derry, Tourism Northern Ireland has launched a new initiative, the Ambassador Circle. The Ambassador Circle will bring together business and academic leaders in advanced manufacturing, technology, life and health sciences, food and drink and financial, professional & business services to help identify, target and attract key business events and conferences to the region.

AMERICAS

Canada’s Unicorn Event Initiative

Source: Edited excerpt from KONGRES

Date: 13 November 2021

Destination Canada has launched the Unicorn Event Initiative, to help raise awareness among government organizations of large-scale, renowned events that correlate with the country’s centres of excellence—with the ultimate goal of highlighting the meaningful difference they make in driving economic growth and destination development. A “unicorn event”—a term coined by Destination Canada—belongs to a class of large-scale conferences that have achieved a world-renowned status and produce well-documented, tangible, economic and social benefits for host countries.

For more articles/news, please visit News & Resources.

Our summary of how destinations are responding to the COVID-19 outbreak. We hope this bulletin will help you in planning your own mitigation and recovery strategies.

GainingEdge Advisory Issue

Legacies – the New Meetings Business Driver

We all have our eyes on what the meetings world will look like post-COVID, and we know for a while we’ll have “vaccine passports.” A more lasting result of COVID will be the proliferation of hybrid events that are producing and distributing multi-channel content. But, in my view there are four key transformative trends that are emerging that have been driven by the pandemic. All four relate directly to the growing focus on meeting legacy:

- Sustainability and UN Sustainable Development Goals (UN SDGs)

- A focus on attracting meetings that are strategically important to a community

- Government engagement in the business of attracting and hosting meetings

- Local community support and engagement in the convention industry

In a way, meeting legacy is both a means and an end. That’s because being strategic and visionary about meeting legacies can create a “confluence of interest” between meeting industries, local host organisations, governments and broader communities.

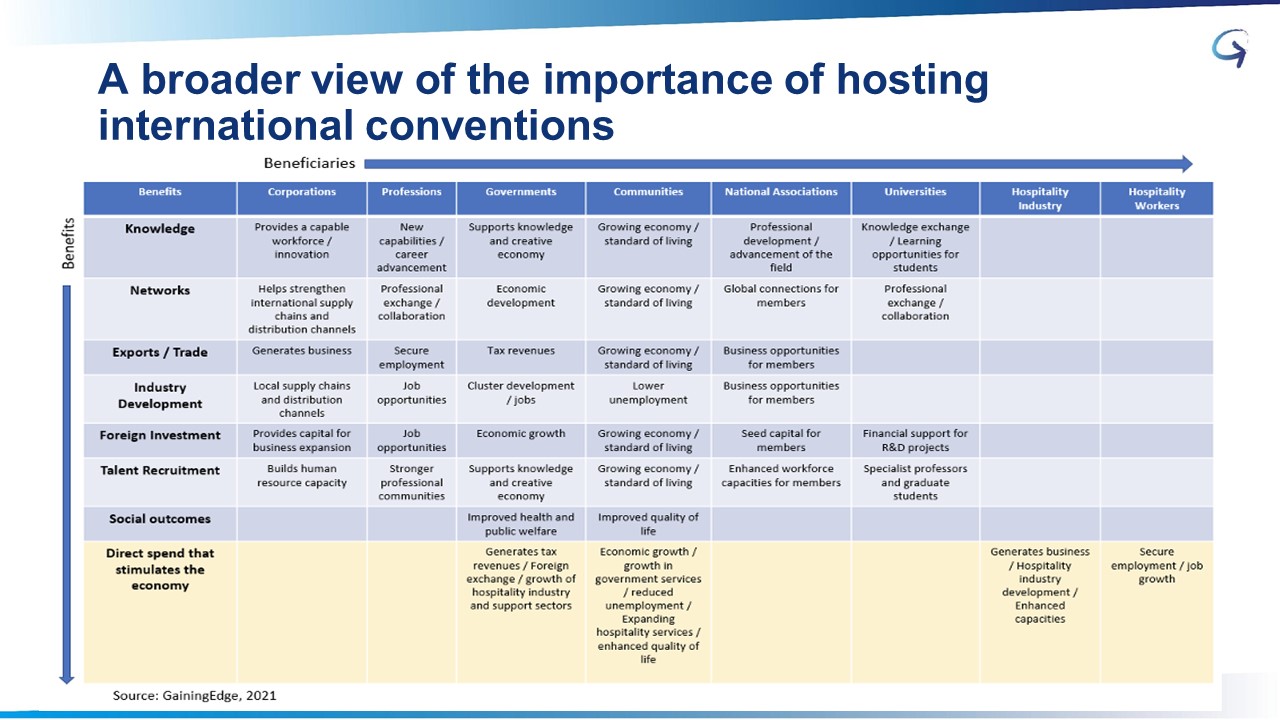

The matrix above offers a quick visual “benefits map” of the types of effects generated by hosting conventions. It shows the range of beneficiaries which include governments and various parts of the local community. It also shows how each of them is positively affected by the “beyond tourism” benefits of hosting meetings. The yellow part at the bottom is our industry’s traditional value proposition, which was always about bringing in visitors so that their spending could help stimulate our economies. As the matrix shows, the benefits of hosting meetings run much broader and deeper. And those benefits directly relate to various types of legacies that meetings can provide.

In projects with MeetDenmark and BestCities, GainingEdge has done a lot of work exploring what we term the “strategic pathway” to legacy. We have developed a model which is essentially the reverse of how legacy is approached by most meetings. Most meetings focus on organising the meeting itself without really thinking a lot about legacy. Then people do a retroactive look at what outcomes the meeting may have generated. Most are confusing meeting outcomes with meeting legacies, and most aren’t actually looking at true meeting legacies at all. Here is a simple way to think about the difference between meeting outcomes and meeting legacies. If a meeting helps to achieve a governmental policy change, that’s a meeting outcome. The legacy is how that policy change actually achieves measurable social and economic benefits into the future.

A more strategic approach is to begin with a creative process of establishing a “legacy vision.” What legacies could be generated from hosting a given meeting? Of course, to do this effectively would require engaging not just the local host organisation, but also interested local stakeholders including businesses, government and the broader community.

The next step is to decide what meeting outcomes would be required to drive the accomplishment of the legacy goals. And, once those necessary outcomes are established to program specific meeting activities that will help to generate those outcomes. This is actually a huge value-adding process, because a destination is then able to present a stronger bid that includes suggested program elements and legacy outcomes. That creates a more compelling case for the destination, differentiating it in a powerful way with the people deciding where to take the convention.

This strategic legacy approach also ticks all four of the boxes above. All event legacies relate to UN SDGs. Focusing on legacy potential adds a strategic dimension to why the event is important to the community. It provides a platform for meaningful engagement between convention bureaus, local hosts, governments and the local community. Best of all, it means that the legacies of hosting meetings will become stronger and more measurable, which over time will help to build momentum and broad support for growing a destination’s meetings industry.

Here’s a question that may help you to crystallise how meeting legacy is the business driver of the future. Imagine that your community is seeking to develop a stronger renewable energy sector. The government wants that, the local renewables industry wants that and ultimately the whole community benefits from that. So, which of the following business cases would be more powerful in both motivating a local host and galvanising local support for a convention bid?

Business case 1: “If we host this meeting on photovoltaics, leaders from that industry from all over the world will come here and share their know-how and also see what we are doing in that science. Leading corporations and investors will come too. It’s our chance to tap into a global network, form relationships, partner in innovation, secure venture capital and attract new talent. Hosting this meeting is a strategic way to stimulate our local photovoltaics industry which will help us to strengthen our renewable energy cluster.”

Business case 2: “If we host this meeting on photovoltaics, some international delegates will come here for a few days and spend some money.”

That’s a rhetorical question, of course. Legacy is the rallying point, the true value proposition and the ultimate community benefit. It is a powerful means as well as an end.

ABOUT THE AUTHOR GARY GRIMMER

Gary Grimmer is Executive Chairman of GainingEdge. He is one of the original founders of AfSAE and GainingEdge provides ongoing pro bono strategic support to the organisation.

Email Gary

For more articles/news, please visit News & Resources.

Advice: COVID-19 for destinations and convention bureaus Issue #7.

Bulletin: COVID-19

REGION WATCH

ASIA

Hong Kong extends subsidy scheme

Source: Edited excerpt from Conference and Meetings World

Date: 8 October 2021

The Hong Kong Special Administrative Region’s (HKSAR) Government has announced the extension of the Convention and Exhibition Industry Subsidy Scheme for six months until 31 December 2022, in response to demand from the industry. Part of the Scheme’s funding will also be allocated to provide a one-off immediate relief measure to private organisers of exhibitions that have a clear track record of being held in Hong Kong, to assist in their pandemic recovery. The amount of the immediate relief will be equivalent to 20% of the average annual rental of the relevant exhibitions, subject to a cap of HKD 1m (USD 128,500) per event.

Singapore companies launch global business events fund

Source: Edited excerpt from CIM

Date: 13 October 2021

A global fund has been launched to invest in the exhibition and events industry, marking the first fund of its kind. Headquartered in Singapore, the Arena MICE Equity fund has been set up by Exhibition International Investment Partners and Abacus Capital, and offers an opportunity to gain exposure to the recovery and growth of the business events industry through publicly listed MICE and MICE-related stocks.

Indonesia’s event socialization initiative

Source: Edited excerpt from Travel Daily

Date: 18 October 2021

Indonesia’s Ministry of Tourism and Creative Economy has held the Cleanliness, Health, Safety, Environment Sustainability (CHSE) Event Protocol Story (CERPEN) campaign for public and local media in Medan, North Sumatra. The CHSE event socialization initiative aims to attract creative workers to socialize CHSE guidance into regional content and culture so that it is easily understood by the local community.

Thailand’s COVID-Free setting

Source: Edited excerpt from Travel Daily

Date: 21 October 2021

The Centre of Covid-19 Situation Administration (CCSA), Thailand’s government’s body overseeing disease control measures and COVID-19 policies, has approved Thailand Convention and Exhibition Bureau’s (TCEB) proposal to allow MICE events to be held under “COVID Free Setting” protocols covering the event environment, personnel, and customers.

Maldives launches “Redefining MICE” campaign

Source: Edited excerpt from M & C Asia

Date: 13 October 2021

A new campaign from Visit Maldives wants to redefine the ‘sombre boardrooms and conference halls’ usually associated with business events and encourage corporates to embrace ‘bleisure’ activities. As well as digital communication, this campaign will include business events FAM trips and dedicated roadshows in different countries.

Philippines’ support package

Source: Edited excerpt from TTG MICE

Date: 25 October 2021

The Philippines’ Tourism Promotions Board (TPB) has beefed up its incentive packages and privileges, and for the first time, is offering financial assistance of up to one million pesos (USD 19,700) for incentive groups and exhibitions. For meetings and conventions, TPB will assist with digital promotions for the event, F&B costs, venue rental, hotel accommodation for foreign buyers, and provide a half-day city tour. Similarly, for exhibitions, F&B for VIPs, hotel accommodation for foreign buyers, and a half-day city tour are new additions.

AUSTRALIA

Canberra’s support package

Source: Edited excerpt from CIM

Date: 1 October 2021

The Australian Capital Territory (ACT) Government has allocated AUD 8 million (USD 5.98 million) to be used to help rebuild those major events that were cancelled this year, while a new major events fund of AUD 2.5 million (USD 1.87 million) over two years will be used to attract new events and AUD 3 million (USD 2.24 million) to expand tourism marketing activity. The Canberra Convention Bureau will also receive AUD 1.3 million (USD 972,653) to help the recovery of the business events sector.

New South Wales AUD 530 million (USD 397 million) support package for business events

Source: Edited excerpt from TTGMICE

Date: 20 October 2021

New South Wales (NSW) government has announced AUD 530 million (USD 397 million) funding package to help revive business events across the state. BESydney will administer the funding programme in conjunction with Destination NSW, on behalf of the NSW Government.

- AUD 60 million: Aviation Attraction Fund

- AUD 150 million to support the recovery of major event activity across the state including A$50 million for a Regional Events Package

- The AUD 250 million for the expanded Stay & Rediscover

- The AUD 6 million to bring business events back to Greater Sydney, Newcastle and Wollongong.

- The AUD 50 million Event Saver Fund

- AUD 10 million put towards a Recovery Marketing Campaign.

New cash grants for Victoria’s National Business Event Program

Source: Edited excerpt from CIM

Date: 5 October 2021

Applications are now open for the next round of Victoria’s National Business Events Program. The funding program has been topped up to provide a three-fold cash boost to attract events to Melbourne and a new funding stream is now available for events hosted in regional Victoria. The expanded program boasts increased funding amounts, up to AUD 90,000 (USD 67,337) per applicant to hold multiyear business events in Melbourne, plus grants available up to AUD 25,000 (USD 18,704) per applicant to hold events in regional Victoria before 31 December 2023.

Source: Edited excerpt from CIM and Visit Victoria

Date: 29 October 2021

Victoria’s AUD 20 million (USD 15.1 million) Regional Events Fund is now open for applications. Funding is available for the attraction, development, marketing and growth of public events across Victoria. Support is available across three streams:

- Stream 1: Regional Event Acquisition – Funding up to AUD 1 million (USD 754,700) to support the attraction of one-off or ongoing major events.

- Stream 2: Event Growth and Development – Funding up to AUD 500,000 (USD 377,350) to grow the economic impact of medium to large-scale events.

- Stream 3: Event Industry Support – Funding up to AUD 50,000 (USD 37,735) to build capability and support the marketing and operations of events that attract intrastate or interstate visitors.

EUROPE

“The Future Role and Purpose of Convention Bureaux” white paper

Source: Edited excerpt from Kongres

Date: 29 October 2021

The Strategic Alliance of the National Convention Bureaux of Europe has published a white paper on “The Future Role and Purpose of Convention Bureaux”. The white paper identifies the main roles that will define national convention bureaux in the future, the challenges to be tackled in order to create sustainable value, the new players and established partners future national convention bureaux will be collaborating with, and the key qualifications and skills needed to thrive in the coming years.

Read it here.

“Maastricht: where heart meets matter” campaign

Source: Edited excerpt from Meetings HQ

Date: 25 October 2021

Maastricht Convention Bureau and MECC Maastricht have launched an international campaign to attract large-scale conventions. With the campaign called ‘Maastricht: where heart meets matter’, Maastricht is positioning itself as the ideal convention city where science, history, and innovation come together. In a fully digitized bid book and using five videos starring Dutch celebrities, the international business market is introduced to Maastricht. Maastricht is also focusing on the legacy of business events.

VisitBritain’s ‘MeetGB Virtual’ 2022

Source: Edited excerpt from Meetings HQ

Date: 27 October 2021

In partnership with MeetEngland, Business Events Scotland, Meet In Wales, Tourism Northern Ireland and London Convention Bureau, MeetGB Virtual has organized an online tradeshow for international buyers to connect in real time with UK destinations, venues and suppliers. The new format will offer both buyers and suppliers flexibility that suits their own schedule, helping to create crucial business opportunities and supporting the business events industry build back demand for live events as it reopens and begins to rebuild.

Success of Vienna’s subvention program

Source: Edited excerpt from AMI

Date: 13 October 2021

Since its launch 5 months ago, the €4 million (USD 4.66 million) Vienna Meeting Fund, being administered by the Vienna Convention Bureau, has seen 242 conferences receive preliminary funding, totalling €2.5million (USD 2.9 million). Most funding submissions came from the fields of human medicine, business, banking and finance.

Glasgow focuses on SDGs

Source: Edited excerpt from AMI

Date: 8 October 2021

The Glasgow Convention Bureau (GCB) is offering an interactive workshop to help planners host sustainable meetings in the city. The Go Greener in Glasgow initiative, which is aligned to the UN Sustainable Development Goals, will provide a support service to meetings planners, professional conference organisers and academic conference ambassadors and provide them with practical tips on delivering sustainable events. This new initiative adds to Glasgow’s existing reputation as a sustainable events destination as it gears up to host the UN Conference on Climate Change, COP26.

#VirtualGlasgow World Walking Route

Source: Edited excerpt from Meetings HQ

Date: 21 October 2021

In another development, in order to welcome delegates who are logging in from home, GCB have launched virtual walks to help online delegates feel part of the live conference experience by enjoying and learning about their virtual host city. Delegates from anywhere in the world can form teams, walk their steps at home and contribute to their team step challenge.

Gothenburg launches hybrid platform

Source: Edited excerpt from Conference and Meetings World

Date: 19 October 2021

Göteborg & Co, the tourism and convention bureau of the Swedish city Gothenburg, has created Hybrid+, a tool that aims to improve digital meeting experiences. The new tool assists meeting organisers reach out to a broader spectrum of participants through hybrid formats.

It’s a PLUS for Madrid

Source: Edited excerpt from Conference and Meetings World

Date: 8 October 2021

Madrid Convention Bureau (MCB) has launched its new digital platform for social and environmental sustainability and legacy – PLUS (Platform for Legacy with us). A major feature of the new service is related to creating legacy, by promoting contact between event organisers and local agents (NGOs, associations, foundations, etc.) and suggesting actions to contribute to this legacy project in the city.

UNITED STATES OF AMERICA

Puerto Rico’s marketing toolkit

Source: Edited excerpt from Northstar Meetings Group

Date: 20 October 2021

Discover Puerto Rico has created a new marketing toolkit with customizable templates for postcards, social media posts, e-blasts and videos, to build attendee excitement before events.

Destination DC’s “Still Connected” campaign

Source: Edited excerpt from Northstar Meetings Group

Date: 20 October 2021

Destination DC, wants planners to know the nation’s capital is open again and is “Still Connected,” via the campaign by that name that highlights three strengths of the destination:

- Connected Capital – gives groups access to local experts from a host of industries, including technology, biotech/pharma, transportation, sustainability and advocacy.

- Connected Community – helps events to be more eco-friendly by linking planners with sustainable hotels, venues, transportation, organizations and more.

- Connected Campus – encourages planners to use non-traditional spaces for events in D.C.’s convention centre district, including art galleries, pubs and churches.

GLOBAL RESOURCES

IAPCO releases COVID-19 National Guidelines

Source: Edited excerpt from Boardroom Magazine

Date: 15 October 2021

IAPCO has put together, in one single document, the current COVID-related protocols and procedures in place within each of its Task Force Members’ destinations. Download the factsheet here.

UFI releases Global Recovery Insights: Road to recovery

Source: Edited excerpt from Meetings HQ

Date: 19 October 2021

This latest in the Global Recovery Insights series of quantitative global survey of trade show visitors and exhibitors, carried out in the summer of 2021, collectively gained 15,000 responses in 10 languages, representing trade show participation in over 30 countries. The study found that demand has returned to pre-pandemic levels for both exhibitors and visitors, with no signs of a fundamental shift away from in-person trade shows as a channel.

For more articles/news, please visit News & Resources.

Our summary of how destinations are responding to the COVID-19 outbreak. We hope this bulletin will help you in planning your own mitigation and recovery strategies.

COVID-19 Factsheets – Guidelines for Live Events per Country

Information Provided by the Members of the IAPCO Global Taskforce of National PCO Associations IAPCO has put together, in one single document, the current COVID-related protocols and procedures in place within each of its Task Force Members’ destinations. Source: Edited excerpt from Boardroom MagazineSee additional Fact Sheets per Country here.

Bulletin: COVID-19

REGION WATCH

ASIA

Hong Kong’s Subsidy Scheme Covers Convention Centre Costs

Source: Edited excerpt from CIM

Date: 29 September 2021

The Hong Kong Government is launching the Convention and Exhibition Industry Subsidy Scheme to help ease financial burdens on the local convention and exhibition industry and help attract domestic and overseas exhibitors, buyers and conference delegates to Hong Kong. The Subsidy Scheme can cover 100 per cent venue rental cost for organisers of exhibitions and international conventions held at the Hong Kong Convention and Exhibition Centre and AsiaWorld-Expo.

Malaysia Offering 50% Sponsorship to Domestic Meetings

Source: Edited excerpt from Conference and Meetings World

Date: 6 September 2021

The Malaysia Convention & Exhibition Bureau (MyCEB) has introduced an additional support package to complement the primary objective of the ‘Meet In Malaysia’ campaign aimed at stimulating the domestic business events industry. Targeting one-day meetings from local markets, the “Let’s Meet Now” package offers 50% sponsorship for one full-day meeting package exclusively for Malaysia-based registered corporate companies and subsidising professional/trade associations and institutions on their meeting costs for their full-day seminars and workshops.

New Asia Convention Alliance (ACA) Formed

Source: Edited excerpt from M & C Asia

Date: 3 September 2021

A series of memoranda of understanding signed on 2 September hopes to pave the way for the Asia Convention Alliance (ACA) which will link key business events players in Thailand, Korea, Malaysia and Taiwan. The alliance aims to rebuild the convention industry by strengthening ties among members, and through the pooling of knowledge and resources, ACA hopes to develop shared opportunities. ACA is focusing on regional events and short-haul travel to spearhead the recovery of business events.

AUSTRALIA

Geelong’s support package

Source: Edited excerpt from CIM

Date: 21 September 2021

Business Events Geelong in partnership with Regional Development Victoria and Great Ocean Road Regional Tourism has launched a AUD 200,000 (USD 144,408) incentive program for those looking to hold business events in the Barwon South West region. The program, backed by the Victorian State Government’s Regional Recovery Support Fund, partially covers the cost per delegate up to the amount of AUD 50 (USD 36).

EUROPE

Italy receives €520million (USD 602.59 million) from EU’s business events compensation scheme

Source: Edited excerpt from AMI

Date: 31 August 2021

Business events companies in Italy could have some of their Covid-19 losses mitigated under a €520m (USD 602.59 million) compensation scheme. The European Commission has approved, under EU State aid rules, the funding package, which will compensate business event companies for the effects of lockdown.

Northern Ireland’s £1 million (USD 1.16 million) support package for business events

Source: Edited excerpt from Meetings HQ

Date: 17 September 2021

Northern Ireland’s Department for Economy has announced a £1 million (USD 1.16 million) conference support scheme to help secure more business events in Belfast, Derry and the region. The scheme will provide conference organisers with £50 (USD 58) for each out-of-state delegate to bring their association conference to the region, with awards ranging between £5,000 (USD 5,796) and £100,000 (USD 115,921) for all eligible events.

AFRICA

Western Cape Business Events Support Package

Source: Edited excerpt from Cape Town CVB Website

Date: 10 September 2021

Cape Town and Western Cape Convention Bureau is offering eligible business event organisers the opportunity to apply for funding, which can be used to assist them in hosting small and medium-sized National Business Events in the Western Cape with 50% of this funding being paid prior to the event to support upfront expenses. The Western Cape Business Events Support Programme is designed to stimulate short and medium-term recovery in the Business Events sector of the Western Cape.

UNITED STATES OF AMERICA

New York City’s “It’s Time to Make it NYC” campaign

Source: Edited excerpt from Exhibitor Online

Date: 16 September 2021

NYC & Company, the official destination marketing organization and convention and visitor’s bureau for New York City’s five boroughs unveiled “It’s Time to Make it NYC”, the organization’s largest marketing and sales effort for the meetings and conventions industry, as New York City’s recovery continues to take shape. Utilizing the tagline “Plan a Meeting for Any Moment,” the new digital campaign features multiple creative executions depicting vibrant imagery of new and beloved New York City icons.

For more articles/news, please visit News & Resources.

Our summary of how destinations are responding to the COVID-19 outbreak. We hope this bulletin will help you in planning your own mitigation and recovery strategies.

GainingEdge Advisory Issue

Destination Planning: Evolving the Role of CVBs

CVBs need to ensure they stay relevant in the rapidly changing world of business events, not only in the marketplace but in their own destination. For too long, CVBs have drawn an invisible circle around themselves and a few trusted allies. Not venturing outside the circle, or letting others in, they too often are only seen when requesting funding.

To be and stay relevant, CVBs need to understand the gaps and opportunities in the destinations they represent. The best way to acquire this knowledge is to speak with and listen to as wide an audience of local stakeholders as possible. And these conversations should not only occur with those who CVBs are most familiar with, but those from outside the industry. In other words, from sources beyond the invisible circle.

By casting a wider net, the CVB will be able to enhance its influence on matters of importance in their communities. Ultimately, being involved will help improve the products and experiences the CVB is promoting to the market. CVBs should be finding ways to engage in discussions around infrastructure development, capacity building, public policy, accessibility, and social, environmental, health and security matters. This does not mean diverting from the CVBs role to sell and market the destination but evolving to a broader mandate. Without such a perspective, the voice of the industry – and the customer – will not be heard when decisions are being contemplated which shape the future of the community (destination).

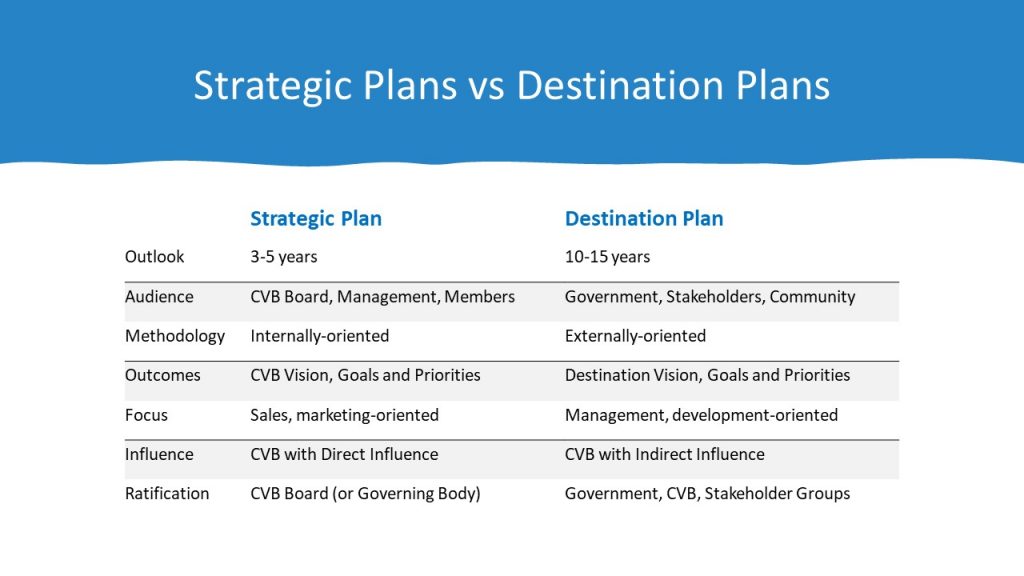

Destination planning is a tool which all CVBs should become familiar, as a way to widen influence and enhance relevancy. A relatively new field, destination planning is facilitated and encouraged by the CVB. Destination plans are long-term, have a broad engagement process, and outcomes which focus on the destination. Strategic plans, by comparison, focus on the CVB itself with outcomes directly influenced and controlled by them. The table below illustrates the key differences between these two types of planning.

Another key tool for CVBs is to carry out objective and quantitative-based assessments, designed to uncover the strengths and weaknesses of the destination. For example, how does a destination stack up on hygiene factors, competitive advantages, and key differentiators? And based on these attributes how well should the destination be performing? Conducting such an assessment enables a CVB to be better equipped at pushing for ways to address shortcomings with the public- and private-sector.

Another tool is for CVBs to determine their role in key destination matters. Most CVBs are accountable and responsible for sales, marketing, and branding of the destination. It is important to be clear whether other organizations also might see themselves as having this responsibility. If so, how does this get addressed? And how about such issues as infrastructure, mobility, services, product experiences, policy and regulatory? The CVB should identify what role it would like to play. If not leading, the CVB should strive to be consulted or, in the least, be kept informed.

Being invited to the table where consequential decisions impacting a destination is something which is earned. CVBs will benefit by stepping out of their comfort zone, getting acquainted with community needs through broad engagement, and in turn bringing the perspectives of the industry and marketplace to the decision process. Tools such as destination planning, destination assessment, and role identification, help CVBs establish a meaningful contribution to these discussions.

ABOUT THE AUTHOR PAUL VALLEE

Paul Vallee is Executive Consultant – Americas, with GainingEdge. He has extensive experience consulting on strategic and destination master planning, organization development, and industry capacity building. His assignments include providing advisory support in Canada, the U.S., Denmark, Brazil, Colombia, Puerto Rico, Aruba, Panama, and Thailand.

Email Paul

For more articles/news, please visit News & Resources.

Advice: COVID-19 for destinations and convention bureaus Issue #6.